Sage sourcing. Value-add ventures. Idealized investment returns.

Transforming Communities. Building Generational Wealth.

Faith-driven multifamily investments delivering attainable housing, durable cashflow, and long-term value one collaborative venture at a time.

Mission

To transform communities through attainable, high quality housing, while creating meaningful opportunities for generational wealth.

Vision

Build communities, elevate futures, and create legacies that endure.

ABOUT SVI GROUP

Sagacious Venture Investments (SVI) Group exists to transform communities by providing safe, high-quality housing. We create opportunities for investors to participate in impactful wealth building projects one collaborative enterprise at a time.

Rooted in strong faith based values, our work is guided by sage sourcing and value-add ventures that provide solid idealized investment returns with integrity, compassion, and true partnership. We specialize in identifying multifamily properties with untapped potential and elevating them through proven, hands on strategies that improve and provide attainable housing. Thus, enhancing neighborhoods, which ultimately strengthen communities at large.

Our team brings decades of combined experience across a myriad of construction, crowdfunding, inspection, insurance, property management, underwriting and various other real estate operations. However, what truly sets us apart is our relationship driven approach. Whether you’re a seasoned investor or taking your first step toward passive income, we walk alongside our investors (buyers) and sellers, providing solutions through education, clarity, and confidence at every step. SVI provides solutions that unlocks access to high-quality multifamily opportunities backed by wisdom, transparency and trust.

At SVI, we’re not just acquiring properties and building portfolios we are inspiring solutions that empower our clients to invest with confidence. Where others see obstacles, we see opportunities as every property has a story, and every investment can add impact to those stories.

Meet our Founder

Doug Harrison

For 28 years, I wore the uniform of our great nation’s armed forces, serving her via the United States Air Force. I enlisted as an airman basic (E1) and retired as a colonel, experiencing unique, often intense moments and serving alongside some of our nation’s best. That journey shaped my deep love for our country.

Long before that, I was raised with an entrepreneurial spirit, learning hard work from my father, a successful real estate broker and landlord. My siblings and I were his demo team, marketing reps, and cleanup crew, witnessing firsthand the trials and triumphs of small business ownership and how business can influence others. Those early experiences built in me a resilience, integrity, and commitment to safeguarding others’ futures.

My lifelong path of service also led me into ministry. For nearly 30 years, I’ve served in chaplaincy, coaching, counseling, mentoring, prison ministry, youth ministry, teaching, and as an associate pastor. My faith in GOD—source of all wisdom (Proverbs 9:10 & James 1:5)—continues to guide and empower me to minister to people from all walks of life. It’s no coincidence that this same calling now aligns with commercial real estate, where I help secure housing needs while supporting others in building dreams and fulfilling legacies through investment.

At SVI Group, I bring the same dedication, strategy, and service-oriented mindset from my military and ministry experience into multifamily real estate. We partner with leaders to grow communities, expand influence, and build legacies that outlast us, while manifesting His Kingdom here on Earth. I’m not simply here to invest—I’m here to empower others to secure their financial futures while making an eternal impact. Backed by a powerhouse team with decades of industry expertise, we identify and transform value-add properties, deliver strong returns, maximize tax advantages, and create long-term wealth and lasting legacies for our partners.

WHY CHOOSE THE SVI GROUP

Choosing The SVI Group means partnering with a team built on

experience, integrity, and a true commitment to people.

We take a relationship-first approach, offering education and clear guidance so that investors and sellers feel confident throughout the process. Our goal is to provide real solutions and build trust that lasts beyond a single transaction.

SVI stands apart with decades of combined expertise, a hands-on value-add strategy, and faith-based values that guide how we operate. We uncover potential, strengthen communities, and create investments that deliver strong returns with real impact. We are committed to datadriven investment over speculation.

WHAT DRIVES SVI

At the core of The SVI Group is a simple but powerful mission: to transform communities through attainable, high-quality housing, while creating meaningful opportunities for generational wealth. Our work is rooted in stewardship, guided by faith-based values, and driven by a commitment to service. We believe every property holds potential, every neighborhood deserves investment, and every true partnership is built on trust and transparency.

We are motivated by the belief that real estate is beyond transactional—it’s a vehicle for positive change. Each decision we make aligns with our desire to elevate the people, families, and communities connected to our projects. This purpose fuels our diligence, our strategy, and our unwavering pursuit of excellence in every venture we undertake.

INVESTMENT STRATEGY

Sage Sourcing. Value-Add Ventures. Idealized Returns.

SVI implements the Path of Progress strategy is where the greatest increases in building and development are projected or occurring. As a result, property appreciation, new construction and demographic increases are a few of the key indicators we seek. Once our proven criteria are met, combined with certain other proprietary guardrails, our team begins the acquisitions process.

Our approach to investing is based on decades of experience, and grounded in purpose, discipline, and service. We focus on multifamily properties with potential to deliver durable cashflow and long-term appreciation, while strengthening those same communities. Every opportunity we pursue reflects a commitment to responsible stewardship, sustainable returns, and meaningful transformation for the families who call these properties home. At SVI, our decisions are guided by faith, integrity, and a mission to build more than wealth. We build communities, elevate futures, and create legacies that endure.

Once a Path of Progress is determined, we adhere to the following model of syndication

Syndication Model & Timeline

Property Discovery & Acquisition

Once potential properties are identified, our expert team evaluates based on key factors - including price, location, and asset quality. This process ensures we only acquire investment properties that meet our goals and expectations and will pass the stringent underwriting process that follows.

Due Diligence & Final Underwriting

The initial underwriting process kicks off a comprehensive due diligence schedule that taps into our extensive structuring expertise. From onsite inspections to a financial deep-dive to mitigating potential risks while maximizing rewards, we dig deep on each potential deal with only the most qualified moving forward.

Stabilizing & Refinancing Assets

Investor Distributions: Once property is stabilized for 90 days, we’re refinance property with long-term financing at FIXEDTM interest rates. At that time, we repay short-term construction/acquisition loans and reward returns on initial investments and follow-on distributions.

Renovations, Property Development & Ongoing Value-add/Core+

To add value, The SVI Group focuses on renovation work that best positions each investment property. By taking this critical step, we are able to refresh or in some cases, overhaul underperforming assets, increasing interest and driving rents in the right direction. This step immediately improves cash flow and long-term capital appreciation, while limiting ongoing maintenance expenses, creating a more valuable asset for all parties.

Managing & Operating

Structured Assets

While it’s essential to choose high-potential investment properties, ultimately assets can perform only as well as they’re managed. At The SVI Group, we’re invested not only in our properties but also in the systems, processes and tools needed to mange a portfolio of income-producing assets across multiple markets.

2025

Founded

20+Units

Multifamily properties

Sunbelt

operating

Integrity

Guided by

309

Multifamily Doors

$8.54M

AUM

18%

IRR

MULTIFAMILY PORTFOLIO

Westbrook Apartments

96 units

Purchase: $4.5M | Hold: 15 months

Sell: $7.3M | Returns: 35%

The Grove Apartment Homes

88 units

Purchase: $4M | Equity raise: $1.2M

Returns: 28.9% | Refi: $6M | Equity: $2M

The Cove Apartments

45 units

Purchase: $2.41M | Refi: 18 months

Appraisal: $3.8M | Equity: $1.39M

Village Square

128 units

(Student Housing) Purchase: $2.65M | Equity raise: $650K

Hold: 5 years | Refi: $4.425M | Equity: $1.6M | Returns: 21%

Magnolia Gardens

48 units

Purchase: $1.6M | Equity raise: $350K

Value add: +$250/month | Equity: $750K

Your Partner in Multifamily Real Estate Success

We are a dedicated team of multifamily home experts, providing exclusive investment opportunities to both accredited and non-accredited investors. Our mission is to help you build long-term wealth through passive income and strategic real estate growth.

We specialize in identifying underperforming or value-add multifamily properties and transforming them through targeted improvements and operational excellence, ensuring maximum returns for our partners.

Property Owner/Seller

In order to properly review an opportunity we require the following:

Property Description

Previous 2 years Operating Statement

Current year Operating Statement (year to date)

Property History (age, ownership)

Recent/projected CapEx projects

Current Rent Roll

Property History (age, ownership)

Financial Structure (if assumable debt)

Market Information (School(s) served, distance, statistics)

Market Information (Sales and rental comps, photographs)

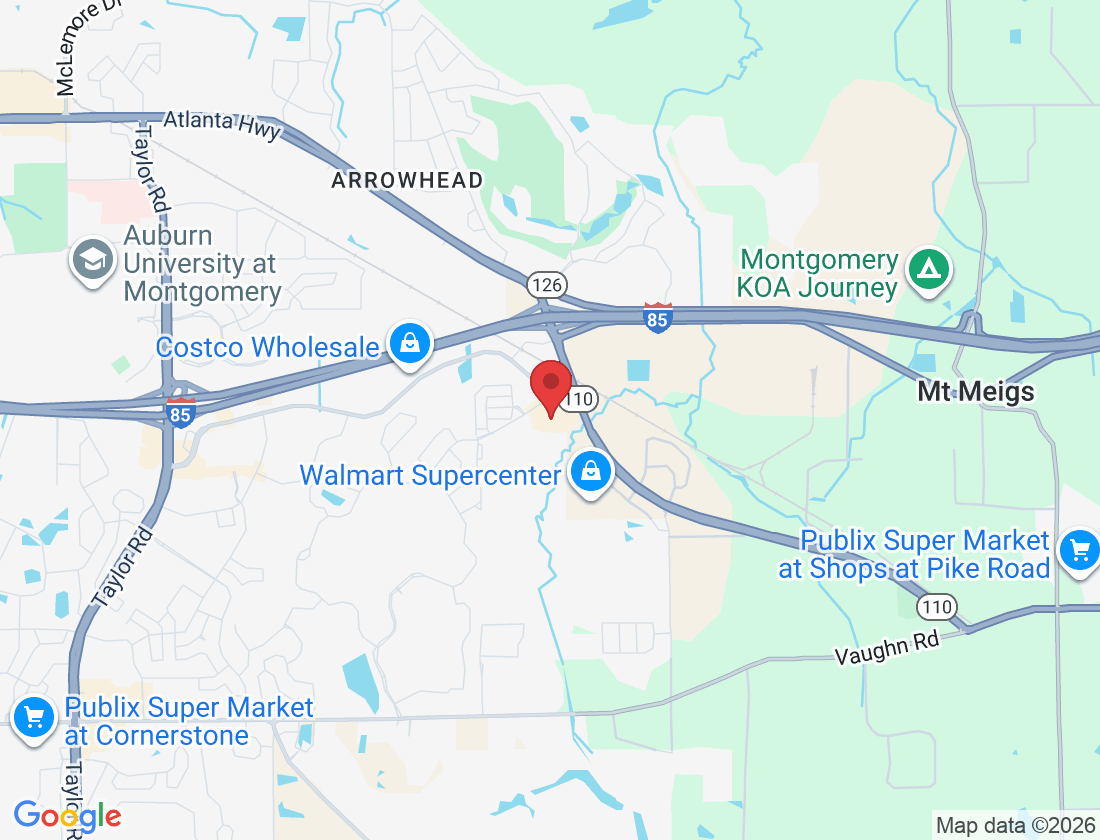

Location Map

Accredited Investor

- Net worth = $1M+ or

- $200K ($300K with spouse) earned income in the past two years.

Sophisticated Investor

- Net worth less than $1M

- $200K ($300K with spouse)

SVI Group Membership

- Receive educational materials, updates & Early Access notifications for Investor Calls

Broker

CRE Brokers with off-market properties prior to going on-market

Investment Criteria

Get exclusive access to our latest investment opportunities, market insights, and educational resources. Membership is free.

1. Target Asset Types

- Multifamily (10–200 units; Class B/C value-add or Class A stabilized

- Industrial (warehouse, flex, logistics, light manufacturing)

- Retail (neighborhood centers, single-tenant NNN)

- Mixed-use with a multifamily component

Avoid: hotels, senior living, heavy development, major environmental exposure.

2. Geographic Focus

- Southeast U.S.: Alabama, Florida, Georgia, Mississippi, North/South Carolina & Tennessee

- Markets with 1%+ annual population & job growth

- Submarkets with incomes above state averages

- Areas benefiting from logistics, education, medical, or manufacturing demand

3. Acquisition Size & Capital Structure

- Purchase Price: $1M – $20M

- Equity Investment: $250K – $5M

- Hold Period: 3–7 years

- DSCR Requirement: ≥ 1.25x

4. Return Thresholds

- Value-Add: IRR 16–22%, EM 1.8x–2.5x, Y1 CoC 4–6%

- Stabilized/Core-Plus: IRR 12–15%, CoC 6–8%, EM 1.5x+

- NNN Single-Tenant: Cap Rate 6.25–8%, 7+ year lease terms

5. Underwriting Parameters

- Multifamily: Cap 6–8.5%, expenses 38–55% EGI, rent upside 10–20%

- Industrial: Cap 6–8%, 14–22 ft clear height, rollover ≤ 40% any year

- Retail: Cap 7–9%,

1. Target Asset Types

Multifamily (10–200 units; Class B/C value-add or Class A stabilized

Industrial (warehouse, flex, logistics, light manufacturing)

Retail (neighborhood centers, single-tenant NNN)

Mixed-use with a multifamily component

Avoid: hotels, senior living, heavy development, major environmental exposure.

2. Geographic Focus

Southeast U.S.: Alabama, Florida, Georgia, Mississippi, North/South Carolina & Tennessee

Markets with 1%+ annual population & job growth

Submarkets with incomes above state averages

Areas benefiting from logistics, education, medical, or manufacturing demand

3. Acquisition Size & Capital Structure

Purchase Price: $1M – $20M

Equity Investment: $250K – $5M

Hold Period: 3–7 years

DSCR Requirement: ≥ 1.25x

4. Return Thresholds

Value-Add: IRR 16–22%, EM 1.8x–2.5x, Y1 CoC 4–6%

Stabilized/Core-Plus: IRR 12–15%, CoC 6–8%, EM 1.5x+

NNN Single-Tenant: Cap Rate 6.25–8%, 7+ year lease terms

5. Underwriting Parameters

Multifamily: Cap 6–8.5%, expenses 38–55% EGI, rent upside 10–20%

Industrial: Cap 6–8%, 14–22 ft clear height, rollover ≤ 40% any year

Retail: Cap 7–9%,

Who We Serve

For investors and owners aligned with purpose, performance, and partnership.

Seeking stable cashflow & long-term appreciation.

Looking for hands-off multifamily ownership.

Aligned with ethical, community-focused investing.

Owners of underperforming multifamily assets.

Sellers seeking transparent, solution-oriented transactions.

Trusted by Investors. Proven by Partnerships.

Real experiences from investors and property owners who value integrity,

transparency, and long-term impact.

“An investment partner you can trust.”

"SVI doesn’t just focus on returns they truly care about people and communities. Their transparency, faith-based values, and disciplined approach gave me confidence from day one. I felt supported and informed at every step of the process."

- Steve H., Passive Investor

“Clarity, honesty, and real partnership.”

"Working with SVI felt different. They took time to educate us, explain the strategy clearly, and align expectations. It wasn’t transactional—it was a true partnership built on trust and shared values."

- Priya R., Passive Investor

“An investment partner you can trust.”

"SVI doesn’t just focus on returns they truly care about people and communities. Their transparency, faith-based values, and disciplined approach gave me confidence from day one. I felt supported and informed at every step of the process."

- Patrick M., Community Leader

Our Conviction

Sagacious Venture Investments Group operates under a FIXEDTM framework anchored in

faith, integrity, and disciplined execution. We are FIXEDTM. Founded in Christ. Executed

with Discipline not to speculation or hype, but to timeless principles of faith, stewardship,

and disciplined execution. At Sagacious Ventures, capital is treated as a responsibility, not a

commodity.

FIXEDTM Investor Ethics & Stewardship Commitment

Sagacious Venture Investments Group operates under a FIXED framework—anchored in faith, integrity, and disciplined execution.

We are FIXEDTM. - Founded in Christ. Executed with Discipline — not to speculation or hype, but to timeless principles of faith, stewardship, and disciplined execution. At Sagacious Ventures, capital is treated as a responsibility, not a commodity

Capital Preservation First: Risk mitigation precedes return optimization.

Truthful Underwriting: Conservative rents, realistic expenses, defensible exit assumptions.

Alignment of Interests: Principals co-invest alongside limited partners.

Transparent Reporting: Clear, timely disclosure of performance and risks.

Community Responsibility: Ethical tenant practices and responsible asset management.

“Moreover, it is required of stewards that they be found faithful.” — 1 Corinthians 4:2

Ready to Get Started?

Take the first step towards building your real estate legacy. Reach out to

our team to learn more about our current opportunities.

Phone: 334-274-7656

Email: [email protected]

Address: 9164 Eastchase Parkway #164 Montgomery, Alabama 36117

Hours: Monday-Friday (9:00am-5:00pm CT)

Saturday (By Appointment)